Table of Contents

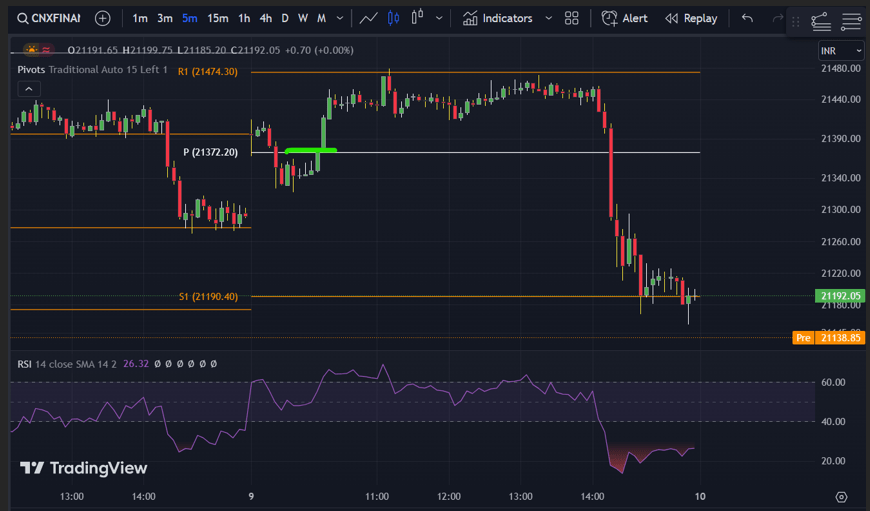

FinNifty Today’s Trade Analysis 09-01-2024

Market Overview:

It was a positive day in the market, with a continuation of the previous fall.

Morning Trades:

Initiated a Call Option (CE) trade around 9:25 AM, but faced a stop-loss (SL) hit.

Took another trade with a small SL hit.

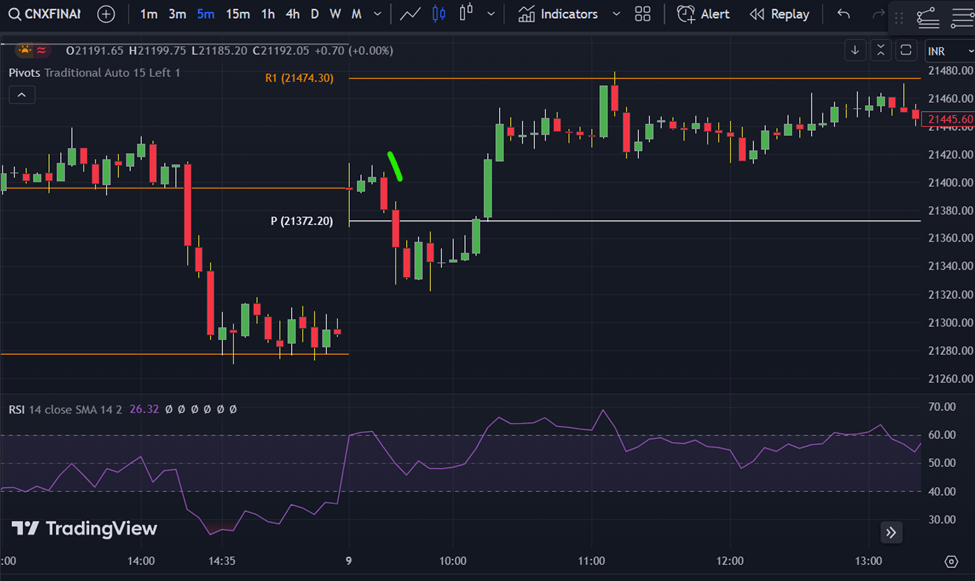

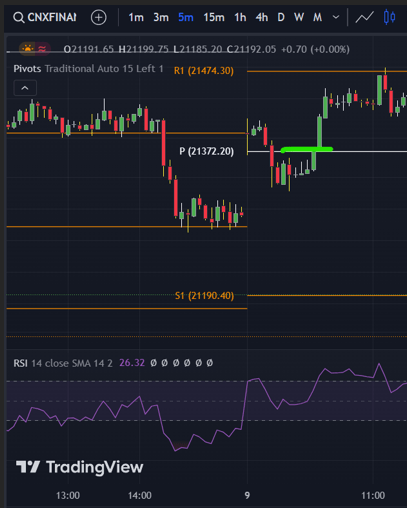

Reason for the trade was a gap-up with the spot price above the Central Pivot.

Observations and Decision-making:

Noticed spot price facing resistance after the gap-up.

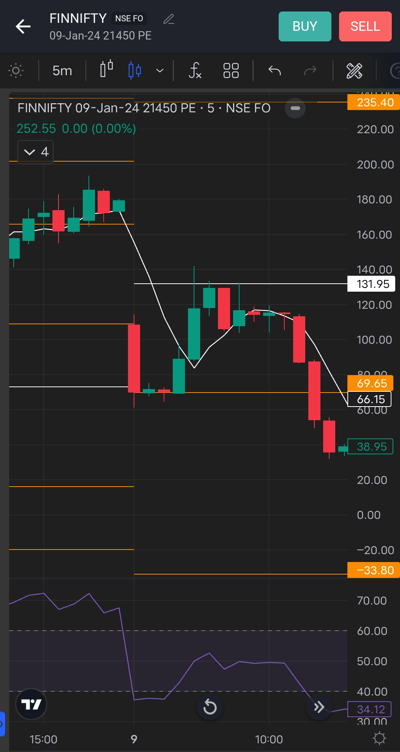

Checked Put Option (PE) chart and identified support at a pivot level.

Entered at ₹80 with a small quantity in OTM strike prices.

Profitable Trade:

Despite initial setbacks, the trade moved favorably from ₹80 to ₹130.

Market Monitoring:

Did not actively monitor the market after the successful trade.

Key Market Movement:

Significant market moves occurred from 10:10 to 10:20.

Opted not to trade during this period due to the confined premium prices within the range of yesterday’s candles.

Open Interest (OI) Analysis:

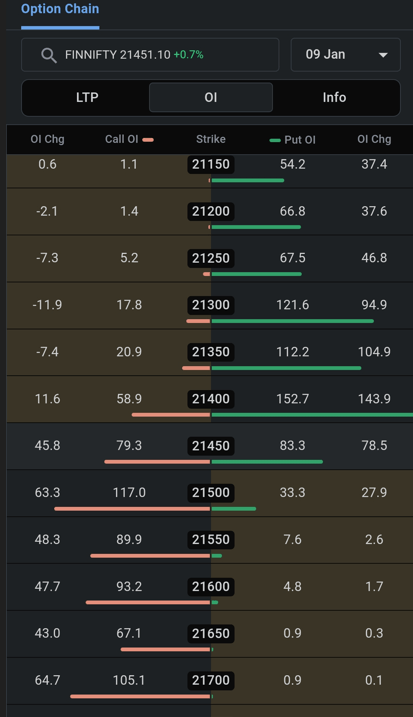

Identified resistance at 21500 and 21400 based on OI, suggesting more sellers at these levels.

Sideways Movement:

From 10:25 to 2:05, the market moved sideways between the range of 21400 and 21500, with OI confirming this range.

Emphasized the importance of avoiding trades during such periods.

Breakout and Price Movement:

After 2:05, a breakout occurred below 21400, prompting sellers to exit and accelerating the price movement.

Noted a rapid price increase from ₹2 to ₹255 after the breakout.

Trade Opportunity:

Highlighted the opportunity to buy during the breakout at ₹2.

How many lots can we buy in Finnifty?

Bulletin

| Sr. No. | INDEX SYMBOL | NEW FREEZE QTY IN LOTS |

|---|---|---|

| 1 | BANKNIFTY | 60 |

| 2 | NIFTY | 36 |

| 3 | FINNIFTY | 45 |

| 4 | MIDCPNIFTY | 56 |

Is FinNifty More Volatile Than BankNifty?

FinNifty (Nifty Financial Services Index):

FinNifty typically comprises financial services stocks, including banks, non-banking financial companies (NBFCs), insurance companies, and other financial institutions.

The financial sector can be sensitive to economic conditions, interest rates, and regulatory changes, contributing to potential volatility.

Individual stocks within the financial sector may have different risk profiles, impacting the overall volatility of FinNifty.

Bank Nifty:

Bank Nifty is a sectoral index that represents the banking sector in India. It includes major banking stocks listed on the National Stock Exchange (NSE).

Banks are generally considered stable and play a vital role in the economy. However, the sector can still be influenced by factors like interest rates, economic growth, and regulatory changes.

Compared to a more diversified index like Nifty 50, Bank Nifty may exhibit lower volatility due to its focused composition in the banking sector.

To assess the current volatility of these indices, you may want to look at recent historical volatility metrics, option implied volatility, or consult financial news sources for up-to-date market analysis.

Remember that the volatility of an index or stock can change over time, and it’s essential to consider your risk tolerance and investment objectives when choosing between more volatile and more stable assets. If the current date is beyond my last update in January 2022, I recommend checking real-time financial data sources for the latest information on the volatility of FinNifty and Bank Nifty.