Market Moves and Missed Chances: Nifty Today’s Trade Analysis and Insights

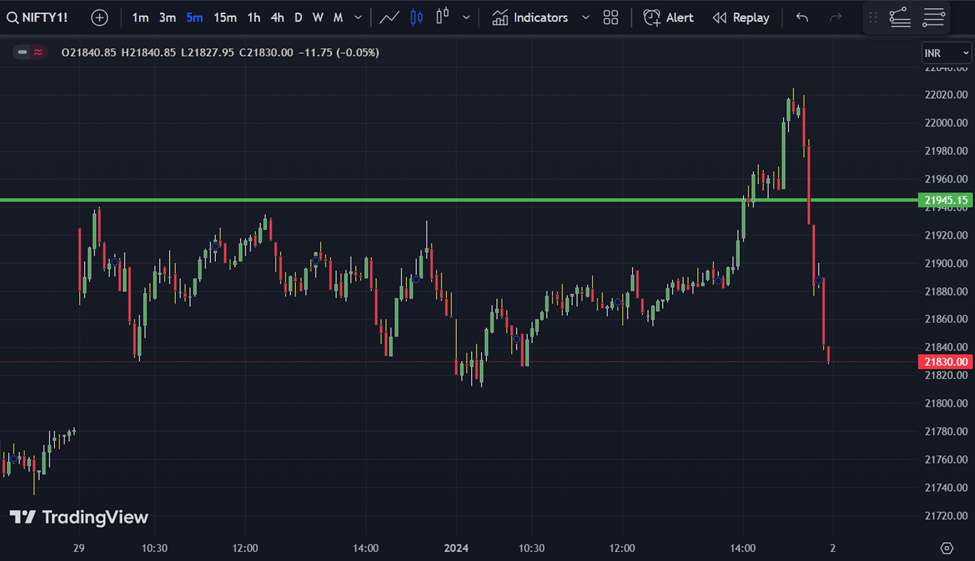

Today’s market started off pretty flat but took an interesting turn, hitting a new high just before 3 pm.

This presented a chance to make a good trade in the call option (CE) side. For example, the Nifty 22000 CE went from 38 to 70 between 2 pm and closing time.

Sadly, I missed that boat because of two earlier trades that didn’t go my way. Even when I re-entered at 41 and sold at 45, it eventually went up to 70++. To add a twist, the market unexpectedly dropped in the last 15 minutes.

I’ll share how you could have taken advantage of that trade.

Trading Tricks and Tips: Nifty Today

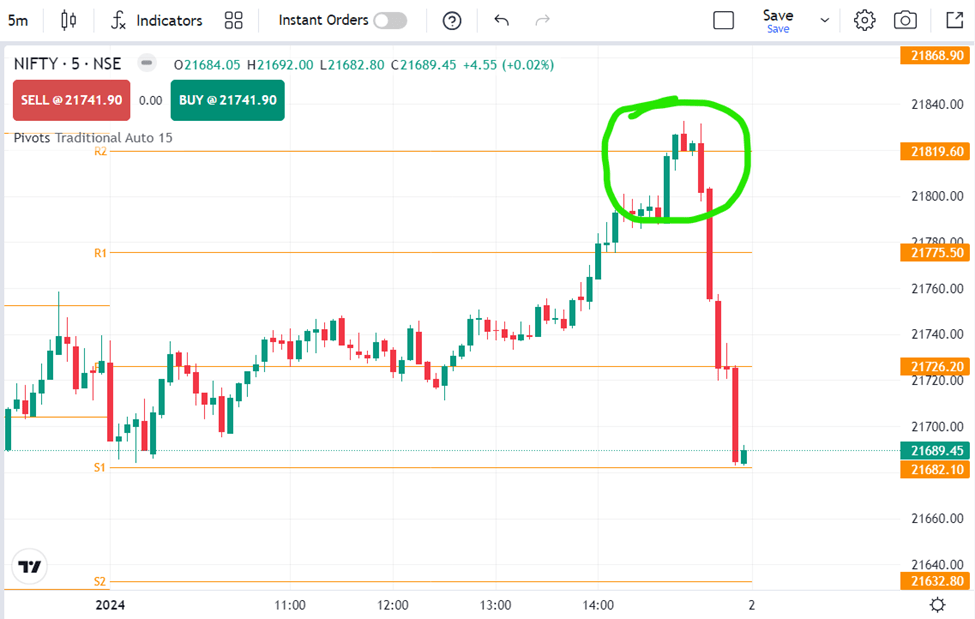

My way of trading involves looking at price movements and Open Interest (OI) data. Checking the NIFTY spot chart, I noticed a strong resistance point around 2:45 pm to 3 pm.

The price hung around there for a bit before dropping at 3 pm, creating an opportunity for a put option (PE) trade.

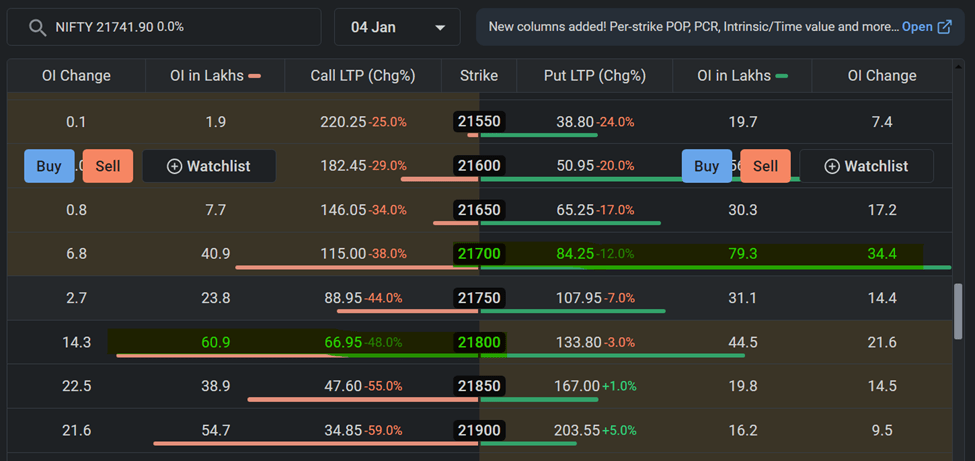

This decision wasn’t random; it was supported by OI data, which showed more interest in the 21700 PUT and 21800 CE.

More OI means more people wanting to sell at those prices, suggesting a reluctance for the market to go below 21700 and above 21800.

Given the current market situation at the 21800 resistance, the key takeaway is to wait for breakout moments or resistance near high OI areas for better trading chances.

Making the PE Trade:

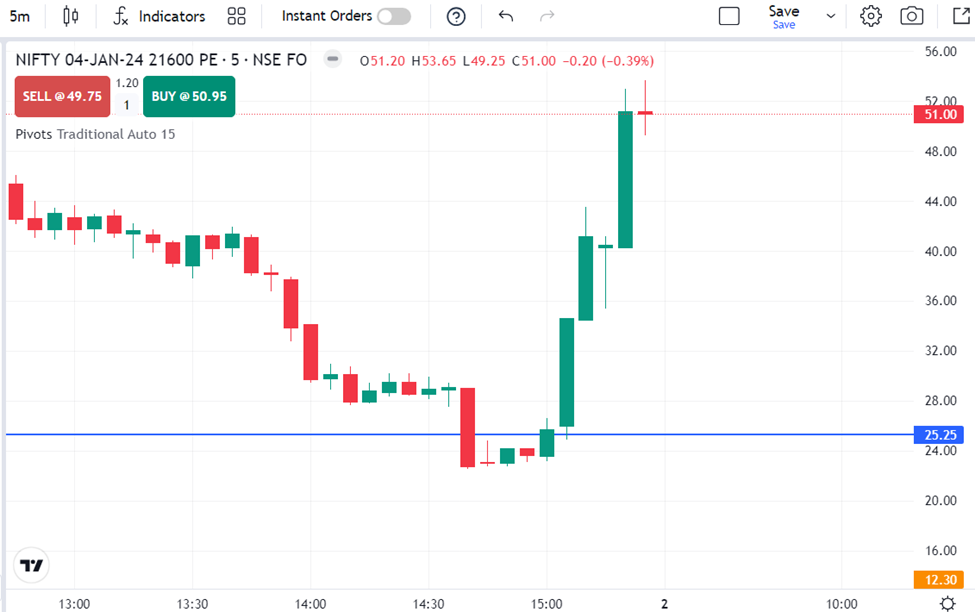

The real action happened when the price dropped in the 5-minute chart at 3 pm, signaling the perfect time to make a PE trade with an out-of-the-money (OTM) strike and a small stop loss.

For example, the 5-minute chart showed a buying opportunity at 26, and the price went up to 50++.

Looking closer at the 1-minute chart, there was a small range breakout, confirming that entering the market at that moment was a smart move.

This breakdown of the analysis shows how important it is to be patient and make strategic decisions when navigating the ups and downs of Nifty trading.

The same analysis you can see in FINIFTY and BANKNIFTY also.

It’s not about forecasting tomorrow’s market moves; instead, it’s about navigating and making informed trades in today’s live market scenario.

What is Options Trading?! If you are not aware 🙂

Imagine you love trading toys with your friends. In the stock market, people trade something called options. It’s a bit like making special agreements about toys you want to buy or sell.

- Call Options – Want to Buy:

Let’s say there’s a cool new video game coming out, and you really want it. You might buy something called a “call option.” It’s like telling your friend, “I want the option to buy that game from you later at a fixed price.” - Put Options – Want to Sell:

On the other hand, if you have an extra toy you’re willing to sell if someone asks, that’s a bit like a “put option.” It means you have the option to sell that toy later at a certain price. - The Playground Agreement:

Now, imagine making an agreement with your friend about trading toys. You give your friend a small toy (payment) for the option to get the cool video game later. This is similar to paying a little money for the right to buy something later. - Open Interest – Tracking Agreements:

Open interest is like keeping track of all the agreements or trades happening in the playground. If lots of kids are making these toy agreements, it means there’s high open interest. - Buying and Selling Agreements:

As time goes by, kids might change their minds. They can sell their toy agreements to others. For example, if you decide you don’t really want the video game, you can sell your call option to another friend. - Risks and Rewards:

Trading options involves risks. If the game becomes super popular, you might make a big profit when you buy it using your call option. But if things don’t go as expected, you could lose a little.

Remember, option trading is like making special agreements about buying and selling toys. It’s a way for people to have fun and try to make some good trades!

Happy New Year

2 thoughts on “Nifty Today’s Trade Analysis and Insights: Don’t Trade Without Reading This – 01-01-2024”