Stock Market Terminology for Beginners PDF – Click Here

Introduction:

Stock Market Basics: A Comprehensive Guide for Beginners

Entering the world of the stock market can be both exciting and intimidating, especially for beginners. Understanding the fundamentals is crucial to navigating this financial landscape successfully. In this article, we’ll delve into the basics of the stock market, focusing on essential concepts such as stock market terminology, the process of buying and selling stocks, and the various order types that shape trading strategies.

Understanding Stock Market Terminology:

Before diving into the mechanics of buying and selling stocks, it’s essential to grasp the basic terminology used in the stock market.

Stocks: Also known as shares or equity, stocks represent ownership in a company. When you own a share of a company’s stock, you own a portion of that company.

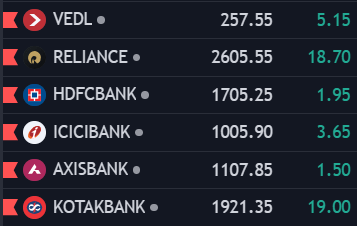

Example:

Bull Market vs. Bear Market: A bull market is characterized by rising stock prices, optimism, and confidence among investors. Conversely, a bear market involves falling prices, pessimism, and a general sense of market decline.

Dividends: Some companies distribute a portion of their profits to shareholders in the form of dividends. Dividend payments are a way for investors to receive income from their stock holdings.

Market Capitalization: This refers to the total value of a company’s outstanding shares of stock and is calculated by multiplying the stock price by the number of shares.

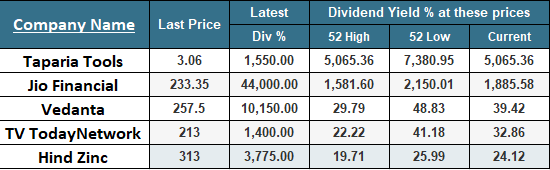

Examples:

How to Buy and Sell Stocks:

Buying and selling stocks involves a series of steps, and understanding the process is crucial for any investor.

Open a Brokerage Account:

To trade stocks, you need a brokerage account. Online brokers provide a platform for buying and selling stocks, and many offer research tools and educational resources.

Examples:

Robinhood – USA

Angel One – INDIA

Upstox – INDIA

Research and Analysis:

Before making any investment, conduct thorough research on the companies you’re interested in. Understand their financial health, business model, and growth prospects.

Place an Order:

Once you’ve chosen a stock to buy, you place an order through your brokerage platform. This can be done as a market order or a limit order.

Confirmation and Settlement:

After executing a trade, you’ll receive a confirmation. Settlement is the process of transferring ownership of the stock from the seller to the buyer, usually taking a few business days.

Stock Market Order Types:

Understanding the different order types is essential for executing trades according to your investment strategy.

Market Order:

A market order is an instruction to buy or sell a stock at the best available price in the market. These orders are executed promptly but may result in a different price than expected, especially in volatile markets.

Limit Order:

With a limit order, you set a specific price at which you are willing to buy or sell a stock. The trade will only be executed at your specified price or better. While this provides price control, there is no guarantee of execution if the market doesn’t reach your set price.

Stop Order:

A stop order becomes a market order once a specific price is reached. This is often used as a risk management tool to limit potential losses.

Stop-Limit Order:

Similar to a stop order, but with an added limit. Once the stop price is triggered, a limit order is placed, ensuring the trade is executed at a specific price or better.

Index:

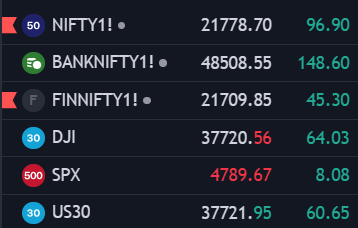

An index is a benchmark that represents a specific segment of the stock market. Common examples include the S&P 500, which tracks the performance of 500 large-cap stocks, and the Dow Jones Industrial Average (DJIA), which represents 30 major companies.

ETF (Exchange-Traded Fund):

An ETF is a type of investment fund that holds a collection of stocks, bonds, or other assets. ETFs are traded on stock exchanges, providing investors with an easy way to diversify their portfolios.

Portfolio:

A portfolio is a collection of investments owned by an individual or an entity. Diversifying a portfolio by holding various assets helps manage risk.

Bullish and Bearish:

A bullish market is characterized by rising prices and optimistic sentiment, while a bearish market experience falling prices and a pessimistic outlook.

Blue-Chip Stocks:

Blue-chip stocks refer to shares in large, well-established companies with a history of stable performance. These companies often pay dividends and are considered relatively stable investments.

Volatility:

Volatility measures the degree of variation of trading prices over time. High volatility indicates larger price fluctuations, while low volatility suggests more stable prices.

Conclusion:

Mastering the basics of the stock market, including key terminology, the buying and selling process, and various order types, is foundational for anyone venturing into the world of investing. As you gain experience, these fundamentals will serve as the building blocks for developing a sound investment strategy and navigating the dynamic landscape of the stock market.

So that is a Comprehensive Guide for Beginners, PDF also available on TOP.